Banking Revenues and the High Price Tag

Since the financial crisis, banks have generated nearly $1 trillion in revenues. However, this success has not come without a significant cost.

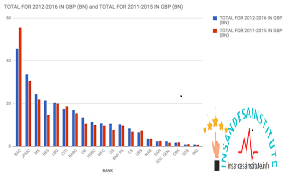

According to a recent study by the Boston Consulting Group, banks have collectively paid $321 billion in fines related to the crisis. While U.S. banks have shouldered a significant portion of these costs, international institutions have also felt the impact.

Record Profits, Yet Heavy Burdens Remain

Interestingly, this research coincides with the FDIC’s report that bank earnings reached a record-breaking $171.3 billion in 2016, with a remarkable $45.6 billion in the third quarter alone. Since the third quarter of 2009, total post-crisis net earnings have reached $987.8 billion, as per FDIC records^1^.

Despite these impressive numbers, the study emphasizes that banks have paid a steep price for their past mistakes and continue to face challenging circumstances.

“The burden of managing these costs is significant for banks, requiring the establishment of a robust non-financial risk framework to avoid repeating the errors of the past,” write the authors of the Boston Consulting study.

The Hurdles to Growth

One of the greatest barriers to growth for banks lies in a web of regulations. Since the adoption of the Dodd-Frank reforms in 2011, banks have faced an average of 200 changes per day, aimed at reducing the likelihood of institutions becoming “too big to fail” and the subsequent need for costly bailouts.

The Boston Consulting report highlights the major challenge of determining how these large institutions can be unwound if they pose a systemic risk.

“Resolution remains the least developed and most pressing aspect of reform,” the report states. “There is still no consensus on how to close down or temporarily halt financial institutions, nor on the preparatory steps or structural measures that may be necessary.”

Regulatory Landscape: A New Administration, but No Retreat

While President Donald Trump has been critical of Dodd-Frank, he has also expressed concerns about the behavior of big banks. The prevailing political sentiment suggests that the White House will seek to ease regulatory burdens on local and regional banks while maintaining pressure on larger institutions. One potential exception to this approach could be the elimination of the Volcker Rule, which prohibits banks from trading for their own accounts.

“Increased regulation is here to stay, much like a permanent rise in water levels rather than a passing tide,” asserts the Boston Consulting report. “We anticipate this trend to persist, despite recent political developments in the U.S. that may pose significant challenges to regulatory implementation.”

The report calls for greater collaboration between banks and regulators to establish sensible policies and urges a focus on implementing technological changes to reduce costs and enhance efficiency.