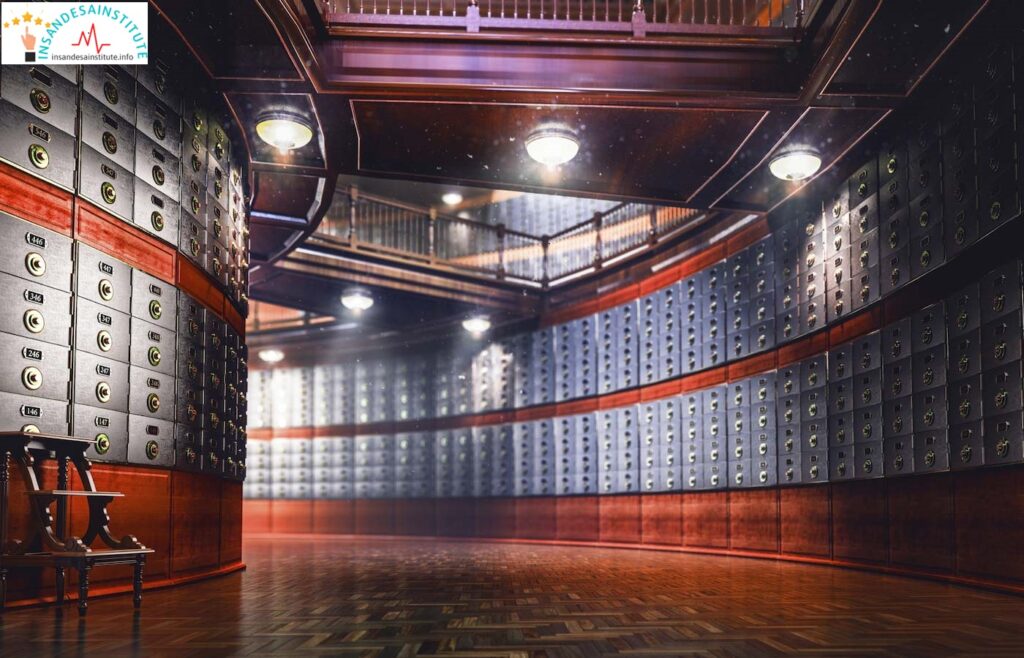

Is the Safe Deposit Box a Thing of the Past?

In this digital era, it’s undeniable that almost everything valuable is stored in the cloud. With this in mind, one might easily dismiss the importance of a physical safe deposit box, considering it a relic of the past. But before you write it off completely, let’s not underestimate the significance of keeping certain valuables securely hidden in your bank’s vault (assuming your bank still offers this service, as many are discontinuing it).

What Belongs in a Safe Deposit Box?

There are undoubtedly items that deserve a place in a safe deposit box. Consider cherished heirlooms like inherited jewelry or precious baseball cards. Additionally, a safe deposit box provides a secure home for vital documents that require utmost protection.

When a Safe Deposit Box Falls Short

Despite its merits, a safe deposit box may not be the best choice for all your belongings. Keep in mind that your bank may have limited operating hours, especially during emergencies and natural disasters. In fact, depending on where you live, the safety of both the bank and the deposit box itself could be at risk. Moreover, recent events like the COVID-19 pandemic have further complicated access to safe deposit boxes due to reduced banking hours and strict appointment policies. It’s crucial to plan ahead and consider alternative options.

What Shouldn’t Go in a Safe Deposit Box?

Certain items are better off avoiding the confines of a safe deposit box. For instance, it’s advisable not to store documents or belongings you may need urgently during weekends or holidays. Instead, experts recommend utilizing a fire-resistant home safe that is securely bolted to the floor for items you may require more frequently.

Now that we’ve discussed the essentials, let’s take a closer look at the items that should never find their way into a safe deposit box.